michigan use tax exemption form

Michigan is uncommon in having only one Tax exemption certificate. 2021 Michigan Business Tax Forms Back Corporate Income Tax Back Sales and Use Tax Information.

It is also found in the Public Law in section 206 of 1893.

. Simply put it is an exemption that exempts a residence from the tax levied by a local school district for school operating purposes up to 18 miles away. Tax Exemption Certificate for Donated Motor Vehicle. All fields must be.

A purchaser who improperly claims an exemption is liable. Buildings Safety Engineering and Environmental Department. Department of Innovation and Technology.

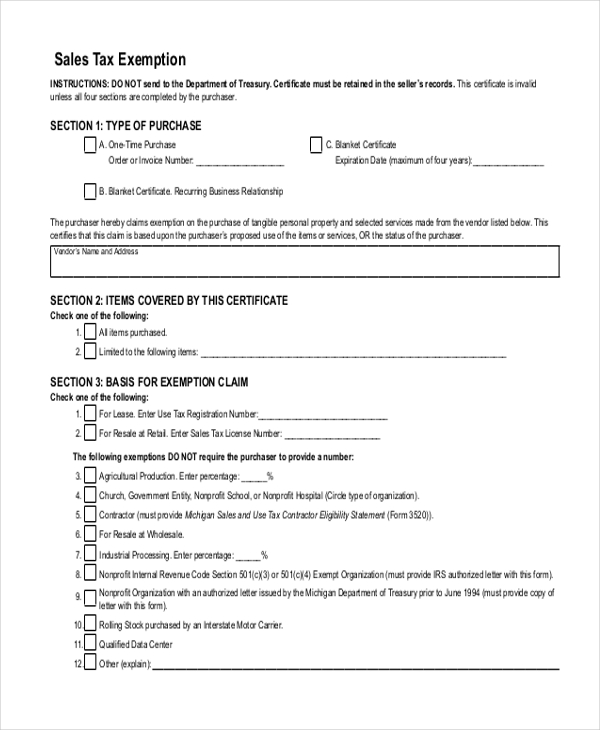

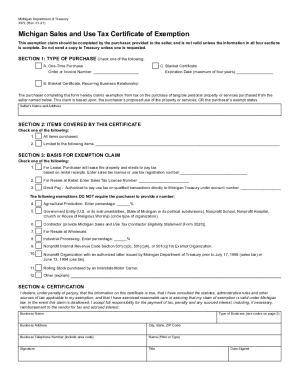

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. 08-12 Michigan Sales and Use Tax Certifi cate of Exemption DO NOT send to the Department of Treasury. Michigan Sales and Use Tax Certificate of Exemption.

Department of Appeals and Hearings. The purchaser must ensure eligibility of the exemption claimed. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

Department of Public Works. All fields must be. Either the letter issued by the Department of Treasury prior to June 1994or.

All claims are subject to audit. If you are looking to purchase goods in. However if provided to the purchaser in electronic format a signature is not required.

It allows suppliers to know that you are legally. Michigan Sales and Use Tax Contractor Eligibility Statement. Electronic Funds Transfer EFT Account Update.

Michigan Sales and Use Tax Certificate of Exemption City of Detroit. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. This certifi cate is invalid unless all four sections are completed by the purchaser.

Sales Tax Return for Special Events. Its amendment has to deal with PRE claims. The rules governing them are in Sections 2117cc and 2117dd of the General Property Tax Act.

A Michigan resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold without the reseller having to pay sales tax on them. You can download a PDF of the Michigan Sales and Use Tax Certificate of Exemption Form 3372 on this page. For other Michigan sales tax exemption certificates go here.

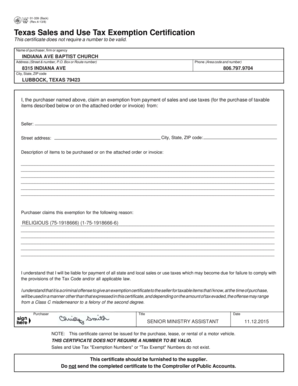

It to the contractor who will submit this form to the supplier along with Michigans Sales and Use Tax Certificate of Exemption form 3372 at the time of purchase. The state of Michigan has only one form which is intended to be used when you wish to purchase tax-exempt items such as prescription medicines. Michigan Sales and Use Tax Contractor Eligibility Statement.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Michigan sales tax. Nothing in this statement should be construed to relieve a contractor from tax liability if it is found that the subject property does not qualify for the exemption. Property Tax Exemptions Property Tax Forfeiture and.

Civil Rights Inclusion Opportunity Department. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. Michigan Sales and Use Tax Certificate of Exemption.

The purchaser must ensure eligibility of the exemption claimed. All claims are subject to audit. 2021 Aviation Fuel Informational Report - - Sales and Use Tax.

In order to claim exemption the nonprofit organization must provide the seller with both. A purchaser who improperly claims an exemption is liable. Evidence of nonprofit eligibility.

Certifi cate must be retained in the sellers records. 2022 Aviation Fuel Informational Report - - Sales and Use Tax. Sales Tax Return for Special Events.

In order to receive the refund the manufacturer must fill out sign and send in Purchaser Refund Request for a Sales or Use Tax Exemption Form 5633 into the Michigan Department of Treasury. Tax Exemption Certificate for Donated Motor Vehicle. All elds must be.

Instructions for completing Michigan Sales and Use T ax Certi cate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on quali ed transactions. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. The Michigan Sales and Use Tax Exemption Certificate can be used to purchase any of the tax exempt items in Michigan.

All claims are subject to audit. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption. Streamlined Sales and Use Tax Project Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act MCL 20595a.

However if provided to the purchaser in electronic format a signature is not required. Please note that while the purchaser is now able to request a refund directly from the Treasury form 5633 has a statement that indicates that the seller paid tax on. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

Michigan Department of Treasury Form 3372 Rev. Electronic Funds Transfer EFT Account Update. All claims are subject to audit.

TYPE OF PURCHASE A. However if provided to the purchaser in electronic format a signature is not required.

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

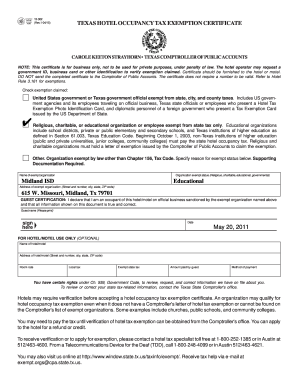

Florida Hotel Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

Sales And Use Tax Regulations Article 3

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Mi Dot 3372 2021 2022 Fill Out Tax Template Online Us Legal Forms

Sales And Use Tax Regulations Article 3

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Resale Certificate Fill Out And Sign Printable Pdf Template Signnow

Michigan Sales And Use Tax Certificate Of Exemption

Fillable Online Iabcstaffstuff Tax Exempt Form For Iabc Staff Stuff Iabcstaffstuff Fax Email Print Pdffiller

Download Policy Brief Template 40 Brief Executive Summary Ms Word